Welcome to our guide to crypto staking. We’re here to show you exactly what crypto staking is and why it’s so popular at the moment. The good news is that crypto staking is pretty easy to understand and that you could get a little extra income from your cryptocurrency investment. If all of this sounds good to you, then you should keep reading our guide to crypto staking.

What is crypto staking?

Simply put, crypto staking gives you an easy way to pick up rewards just by hanging onto certain kinds of cryptocurrency. It’s a little more complicated than that, but it’s actually been termed as a way of making a passive income, as opposed to crypto trading where you actively buy or sell a particular cryptocurrency.

By staking your cryptocurrency on a blockchain, the crypto will actually be put to work. This is because your crypto will be used as part of the consensus mechanism that is used to verify all transactions on that particular blockchain.

In a way, staking can be seen as being similar to crypto mining. This is because your crypto will get used as a kind of legitimator for any new block that gets added to the blockchain, and you’ll get rewarded in the form of a cryptocurrency.

Why is crypto staking so popular?

The fact that staking means getting rewards means that it is a hugely popular branch of the cryptocurrency phenomenon. After all, you don’t actually have to do anything to get rewarded for holding your crypto on a blockchain.

This is preferential to just keep your cryptocurrency in your wallet, as you’ll be making your crypto work for you in a way that should prove more profitable than just hoping that its market value rises.

It’s also important to note that crypto staking is a good way to maintain the legitimacy and stability of a blockchain. After all, you’ll be speeding up transactions and will help the network become more attack-resistant. This is why some crypto stake holders are sometimes given a say in how the blockchain operates in the future.

The most popular cryptocurrencies to stake

It’s important to remember that crypto staking isn’t something that you can currently do with all cryptocurrencies. At the moment, crypto staking tends to be restricted to a handful of cryptos such as Tezos and Cosmos.

However, it’s worth noting that the recent ETH2 upgrade has meant that the hugely popular Ethereum is now open to crypto staking – definitely something to think about if you’re picking up Ether from play to earn crypto games or are using this crypto for esports. The Ethereum-based form of crypto staking allows you to stake a certain number of your crypto assets and you’ll then get a percentage-based reward depending on how long you hold your stake.

Why can’t you stake Bitcoin?

Given the fact that Bitcoin is the world’s original and largest cryptocurrency, it may come as a surprise that you can’t stake this crypto. However, Bitcoin is based on some relatively simple blockchain technology that lacks the newer Proof of Stake consensus mechanism that is able to boost speed while lowering fees.

How to start crypto staking

The good news is that pretty much anyone can start crypto staking. Each crypto blockchain will have its own demands in terms of how you can start staking. For example, you may have to buy a minimum amount of Ether to start staking on the Ethereum blockchain. Plus you will need to have the necessary computer rig capable of handling the required validations all around the clock.

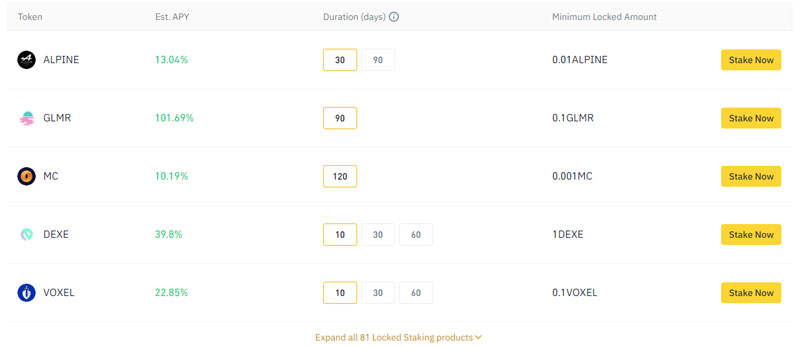

If this doesn’t sound too attractive, then there are alternative ways of getting started with crypto staking. Growing numbers of crypto exchanges are starting to introduce their own crypto staking services. This is where you assign a certain amount of your crypto investment into a staking pool that is shared among other investors.

As a result, you’d get the standard staking rewards minus the exchange’s cut. A big benefit for this is the fact that you don’t have to sacrifice your own computer to carry out the validation and there’s no need for a large initial outlay in the required cryptocurrency.

© Binance

Tips for successful crypto staking

We couldn’t give you a guide about crypto staking without giving you some handy tips. Here’s some simple advice about getting started staking cryptos:

- Consider the economic backdrop: The value of cryptocurrencies tends to suffer when the markets are in turmoil. This means that you should reconsider staking your cryptocurrencies if there is an overall downturn in the market.

- Note the time limits: All forms of crypto staking involve time limits over how long you have to stake your investment on the blockchain. Be realistic about whether these time limits are going to be right for you.

- Pick your crypto carefully: There are only a handful of cryptocurrencies that you can stake and it’s a good idea to do some research into how these cryptos work before you start staking them. This will help you gain a deeper understanding as to whether that crypto’s fortunes are on the rise or whether it would be a bad idea to lock your investment on the blockchain.

A quick warning about crypto staking

Firstly, all forms of cryptocurrencies are by nature risky. This is because they have no actual value in themselves, and we’ve seen major cryptocurrencies such as Bitcoin take an 80% fall in value before.

Secondly, most forms of crypto staking require you to keep your stake ‘locked-up’ on the blockchain for a minimum period of time. This means that you are effectively powerless from transferring your crypto even if the market takes a massive downturn. This means that the value of your cryptocurrency investment could become worthless in a matter of hours and there would be nothing that you could do about it.

Plus we should note that crypto staking can have a high cost of starting up. This is because you may have to make a significant crypto investment to get authorised as a validator. There’s also the fact that you’ll have to keep your computer running day and night otherwise your investment could be slashed.

Conclusion – Why crypto staking is only going to get bigger

Crypto staking is yet another inventive step in the evolution of blockchain technology. Like crypto mining, it gives you the chance to earn cryptocurrencies without having to directly buy them. What’s best is that crypto staking is a relatively passive form of income and you could get some excellent rewards simply by assigning some of your investment on the blockchain.

It’s going to be interesting to see where crypto staking goes from here. Hopefully, it won’t suffer the same fate of crypto mining that has become pretty much an industrial process. But with more crypto brokers introducing their own user-friendly staking services, there’s hope that more and more casual investors can get involved.

Remember that crypto staking hasn’t been with us for too long, and it’s only just starting to feature some of the heavyweight cryptocurrencies such as Ethereum. All of which suggests that crypto staking is something that we’ll be hearing a lot more of in the future.

EN Global

EN Global  BR Português

BR Português